China has decided to open up its telecommunications, education and healthcare sectors to foreign investors after suffering a sharp drop in foreign direct investment (FDI).

An executive session of the State Council, chaired by Chinese Premier Li Qiang, on Monday reviewed and approved four documents aimed at helping the country attract foreign capital.

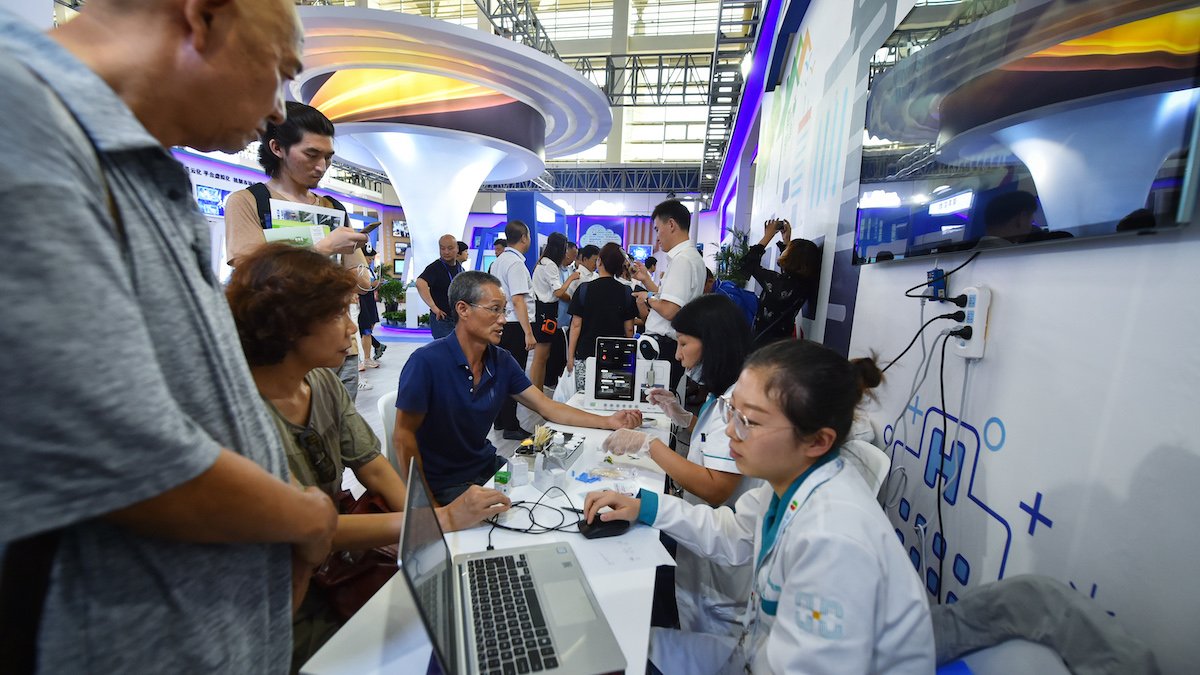

The documents include the 2024 edition of a set of special administrative measures, or a negative list, for foreign investment access. According to the negative list, China will further relax restrictions on foreign investment by completely abolishing entry barriers in the manufacturing sector, while accelerating the opening of sectors such as telecommunications, education and health services.

“The latest executive meeting of the State Council decided to modernize the country’s service industry by encouraging cross-border flows of essential resources such as talent, capital, technologies and data,” Zheng Wei, a researcher at the China Outsourcing Institute in Shanghai, a researcher. unit that operates under the Ministry of Commerce, he said in an interview for the Economic Information Daily.

“Opening up the telecommunications, education and health sectors, which are relatively sensitive industries, demonstrates China’s determination to proactively open its economy to the world,” Zheng said. “In the future, China will take more substantial measures to accelerate its opening-up and further enhance foreign investors’ confidence in the country.”

When China began opening up its economy in the 1980s, it initially relaxed restrictions on foreign firms investing in its manufacturing sector.

In the auto sector, foreign firms were required to establish 50-50 joint ventures with Chinese partners to conduct business in China. But such a restriction ended in 2022.

For national security reasons, China has never opened up its telecommunications, education and health services sectors, which are still controlled by state-owned enterprises (SOEs). Beijing is expected to ease rules in these industries step by step.

China has no plans to open up its defense, energy and media industries in the short or medium term, according to most observers.

FDI and jobs

The State Council’s latest decisions came after China’s foreign direct investment fell 29.1 percent to 498.9 billion yuan ($69.5 billion) in the first half of this year from a year ago.

At the same time, China’s overseas direct investment (ODI) rose 16.6% to $72.62 billion as many Chinese manufacturers had to build production capacity overseas either to reduce costs, either to avoid new tariffs imposed by the West.

China needs to boost its foreign investment because the labor market has so far failed to create enough jobs for young people.

According to the National Bureau of Statistics (NBS), China’s youth unemployment rate rose to 17.1 percent in July, the highest level since the new record-keeping system began last December. In June of this year, the figure was only 13.2%.

In June 2023, the youth unemployment rate reached a record high of 21.3%, the SNB said.

For much of the second half of 2023, China suspended reports on the youth unemployment rate. It said it was reevaluating its calculation methods. In February this year, the SNB stated that the youth employment rate, calculated using a new method, was 14.9% for December last year.

The figure hovered around 14% in the first half of this year before rising significantly in July. Chinese officials said the increase was caused by an increase in the number of recent graduates during the summer.

Do I praise Deng again?

The Central Committee of the 20th Communist Party of China concluded its third plenary session on July 18 with the adoption of a five-year plan aimed at modernizing Chinese industries and promoting economic reforms.

On July 30, CCP General Secretary Xi Jinping said that the Chinese economy “is facing more negative effects due to changes in the external environment, while effective domestic demand remains insufficient.”

The same day, in a letter, Xi called on Hong Kong businessmen to boost investment in mainland China and contribute to the country’s reform and opening up. However, responses from Hong Kong tycoons have remained lukewarm so far.

On August 16, Qiushi, the official theoretical journal of the CCP, published two articles to praise former Chinese leader Deng Xiaoping for his contributions to the reform and opening up of the Chinese economy in the 1980s.

The two op-eds also said that Deng stabilized China’s relations with the United States, the Soviet Union, Japan and Britain.

Ming Jing News, a Chinese news site in Canada, said in a commentary that the two Qiushi articles were aimed at using Deng’s reputation to unite the CCP, which is now led by Xi. The two articles are said to be not politically incorrect as they only remind party members to support Xi’s economic reforms.

Capital outflow

Beijing is not only keen to attract foreign investors to boost its foreign direct investment, but also to take precautions to avoid any panic selling in the Shanghai and Shenzhen stock markets. Starting Monday, China stopped publishing daily data on overseas fund flows.

In April, Chinese officials already suggested reducing real-time data on foreign fund flows from Hong Kong to mainland Chinese stock markets. They made the decision at the end of July.

Some analysts said Beijing hoped to reduce market volatility induced by the high-frequency data and steer investors toward longer-term indicators such as the People’s Bank of China’s quarterly reports on financial assets held by overseas entities.

They said the move would not address the root of the problem, which was caused by weak global investor confidence in the Chinese economy, while it would reduce the transparency of China’s cross-border capital flow.

Chen Hongbing, chairman of Anhui Meitong Asset Management Ltd, told Taiwan’s UDN.com that the daily data of the northern mutual funds is considered by investors as an indicator of general market sentiment. He said the decision to stop the release of data may help curb speculative activities and reduce market volatility.

However, some individual investors said it was unfair that they could not now get the data in real time, while brokerage firms could still monitor and predict market trends using their own data.

Read: The housing crisis still haunts China’s investment and consumption

Watch Jeff Pao on X: @jeffpao3

#Chinas #telecoms #education #health #open #FDI #Asia #Times