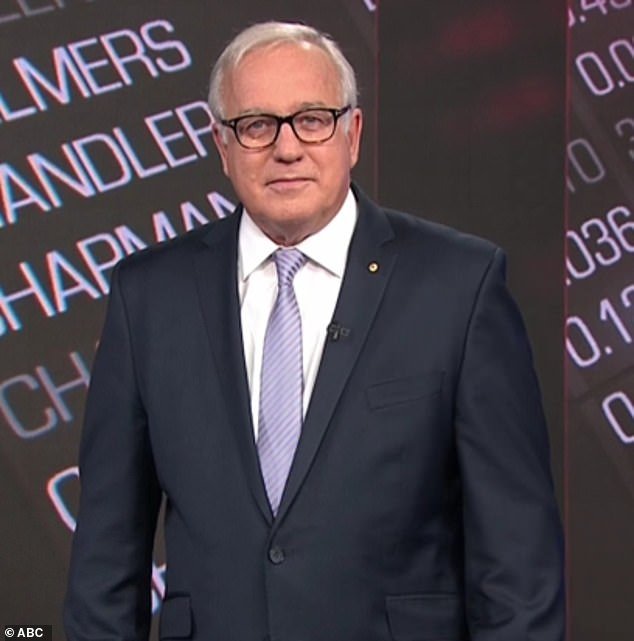

Financial guru Alan Kohler has said excess immigration is to blame for Australia’s housing crisis and is being fueled by the influx of international students.

Kohler, the ABC’s financial expert, said it was not the permanent migration of workers that was primarily responsible for the increase in demand – and prices – for housing, but the growing number of foreign students.

“Most of Australia’s migrant intake has been outsourced to universities and colleges, which see the new arrivals as customers rather than migrants,” he wrote in an article for The New Daily.

“They (universities) use ‘education agents’ from other countries to recruit them, paying sales commissions to incentivize them.”

Kohler saw the agents as “like legal traffickers” — eager to get their cut, but with no interest in the negative consequences.

Kohler said policy changes to immigration in 2001 under the Howard government saw Australia “changed forever”.

The changes have made it much easier for students from countries such as India, China and Pakistan to enter and gain permanent residency, compared to before when it was “almost impossible”, Mr Kohler explained.

Kohler said that following the changes, Australia’s migrant intake – including students – tripled to 300,000 a year between 2005 and 2008.

Financial guru Alan Kohler has said excess immigration is to blame for Australia’s housing crisis, which is only being fueled by the influx of international students.

The Albanian government now plans to limit the number of international students accepted into universities.

The proposal is widely opposed by tertiary education providers, who have become increasingly reliant on upfront fees paid by foreign students rather than local HECS-paying students.

It is understood the number cap could rise if tertiary institutions funded student accommodation, easing fierce competition for properties in the wider rental market, with Australia’s major cities having a very tight vacancy rate of 1.3 per cent.

Any reduction in the number of international students would significantly affect the revenue streams of universities, having a knock-on effect on the funds available for research projects.

“The view of the current Labor government is that universities have become dependent on foreign students and should not decide Australia’s population growth based on their desire for revenue,” Kohler explained.

“Also, universities really need money in the absence of government funding – without foreign students, research would dry up and the national scientific effort would suffer.”

The imbalances created by a growing population are not only felt in the rental market and house prices, but also in labor shortages – especially in the construction sector.

This led to higher prices for professionals, which in turn led to the collapse of a record number of construction companies and yet more shortages in housing supply.

The Albanian government’s target of 1.2 million new homes by 2029 has been predicted to fail almost since it was announced and is already behind schedule.

The target is to build 240,000 homes each year, but this number now stands at just 150,000.

The government also hopes to reduce net overseas migration to 260,000 this financial year, after reaching 547,300 in 2023.

“Reducing Australia’s population growth to something approaching the real capacity of the construction industry to build homes for all – as opposed to what the government would like it to be – will not be easy,” Kohler said.

An Australian earning an average full-time salary of $100,017 could buy a $650,110 home with just a 20% deposit of $130,022, with banks only able to lend someone 5.2 times their pre-tax salary.

This person would be in mortgage stress buying the typical unit in Melbourne or Brisbane and paying $3,353 a month in home loan repayments – or more than a third of their salary.

Someone renting in Sydney, where $694 is the average weekly unit rent, would be offering almost $3,100 a month to a landlord.

The mid-priced home in Australia’s major capital cities is out of reach for the average Australian working self-buyer, meaning they are limited to units or a house with a small yard in an outlying suburb.

The government now plans to limit the number of international students accepted into universities (stock image University of New South Wales)

#Finance #expert #Alan #Kohler #reveals #littleknown #reason #Australias #housing #crisis #moment #nation #changed