Building a budget means finding fans on social media.

Photo: IGOR STEVANOVIC / PHOTO SCIENCE

Social media trends tend to focus on vacations, parties, and dining out—it’s all about spending money to feel good. But some influencers encourage their followers to save money.

American comedian and influencer Lukas Battle went viral in early 2024 for promoting the idea of strong budgeting.

It was all about being vocal with your financial decisions.

Lara Meyer of New Zealand-based financial website Sorted said that while hard budgeting takes some courage, it’s good for your bank account in the long run.

“There will always be times in life when we have to make the decision that ‘I actually can’t afford this’ and it takes a little bit of courage.”

“I’m in this situation right now. My dear friends are all planning a trip to Japan to go skiing in January. I thought my husband and I would be able to go, but realistically I don’t like debt, so I’m not going to put it on a credit card.

“So I had to tell people, ‘I don’t think we can afford to come. I will not bow under financial pressure to come with you. We will have a wonderful holiday in New Zealand.” “

Napier woman Rachel Leutele started her Instagram page The Savvy Saver to share budgeting techniques with her friends.

Rachel Leutele is The Savvy Saver on Instagram

Photo: given

“The first book I ever read was The Barefoot Investorand that was the first kind of book that set the foundation for my budget journey, that taught me a little bit about my mindset and why I wanted to do what I wanted to do.”

“One of my friends actually said ‘you should post this on social media and try to help people.’ So I did and it exploded from there.”

But six years ago, she had no idea about saving money.

In 2018 she was working as a lawyer and had just married her partner, who was studying at the time.

The newlyweds moved in with their family and paid $130 a week aboard.

“For the first, I think three years of marriage, I lived with my parents in Hamilton. I had just finished university, I had been admitted to the bar. I had absolutely no savings.

“We didn’t know what we were doing. We wasted all our money.”

Not long after, Leutele became pregnant and had to quit her job due to health problems.

“I was diagnosed with this thing called hyperemesis gravidarum, which is just a debilitating disease. You just vomit almost all the time. So obviously I had to quit my job. My husband had to drop out of school and ended up getting a full-time job. .”

The couple’s financial troubles began in 2021 when she was expecting her second child and they had to move to Napier due to her husband’s job.

Suddenly they found themselves in a new city with rent and bills to pay and thousands of dollars in debt.

“When we moved to Napier we managed to get a bond and started renting.

“We were $20,000 in debt and just trying to figure out how we could survive on one income so I could continue to be a stay-at-home mom.”

That’s when she decided they needed a budget.

“We tried a few different methods, but nothing really worked for us as a single-income family, because what we found was that a lot of the advice was to make more money or spend less, but that is very hard to do when you are in one family. income.”

“I was kind of forced to find a way that worked for us so I could stay at home, because at that point, making more money wasn’t an option for us.”

Three years later, Leutele and her husband had paid off their debt and were on their way to buying their first home.

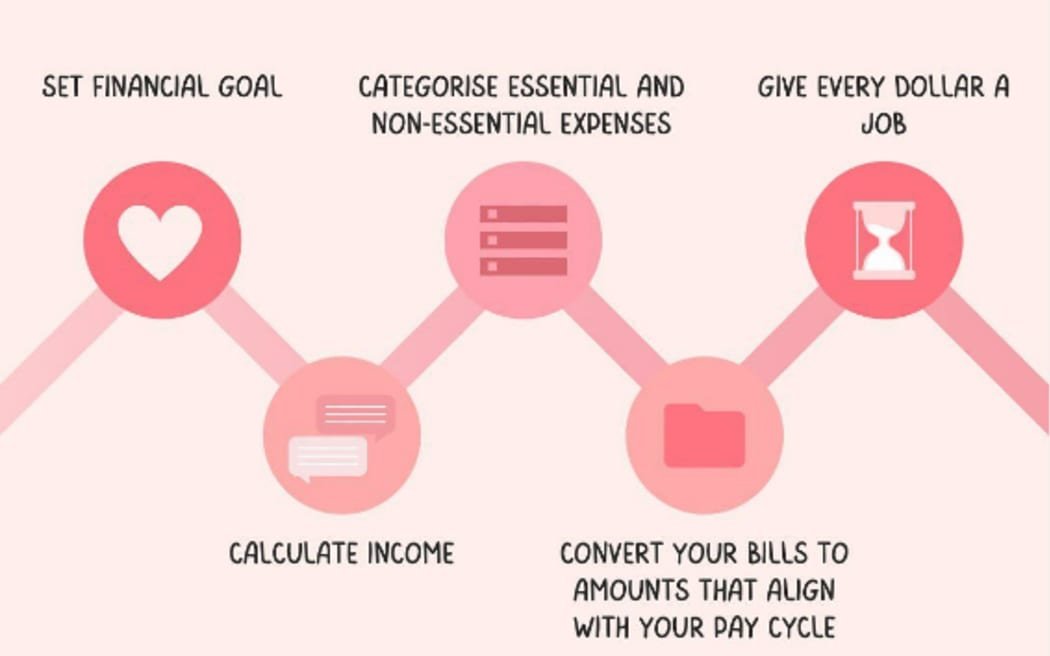

She said it was all down to the “zero-based budgeting” method.

“The zero-based method is that all of our money is pulled into one account and on payday we allocate every dollar.”

“They call it ‘put every dollar to a job,’ and you’re essentially moving all that money from that account to different accounts.”

“We split the income into a bill account, a car maintenance account, our family fund account, [and] the children’s needs, so the account where our money essentially went is now zero at the end of payday, but all our other accounts are now topped up with money.”

Sorted’s Meyer was passionate about the method.

“I like the idea of it. I mean, that’s kind of what I do, you know, I know what my utilities are. There is no money just washed around it. It’s hired utilities or mortgage or rent, or I pay it into a savings account or KiwiSaver or a clothing fund – it’s allocated.”

There are a whole range of budget styles that are proving popular on social media.

William Tieu is the financial engineer at TikTok.

Photo: given

Financial advisor William Tieu has nearly 100,000 followers on his TikTok account, The Financial Engineer.

One method he recommended is 50-30-20, needs, wants and savings.

“The 50-30-20 rule is you take your income and 50 percent of it goes towards necessities, so that’s your housing, gas, all the things you basically need to live.

“Thirty is your wants — coffee, eating out, entertainment, and then the remaining 20 percent will either go toward savings or setting up an emergency fund.”

Tieu said anyone who wants to start budgeting should take stock of their income and expenses as a first step.

“The easiest thing most people can do is print three months of your statement, because that’s where the salary goes.

“Track your income and then track all your expenses and then you’ll quickly figure out where your money is going, because a lot of people don’t really know where their money is going. They just spend like crazy.”

But he said the most important step is to set a goal before you start.

“With any budget, the only reason it would work is if there’s a purpose behind it, otherwise it’s just numbers and you’re just not going to stick with it.”

#Strong #budgeting #Influencers #board #big #spending #trend