(Bloomberg) — U.S. job growth in the year to March was likely much less robust than initially expected, risking fueling concerns that the Federal Reserve is falling further behind the curve on interest rate cuts.

Bloomberg’s most read

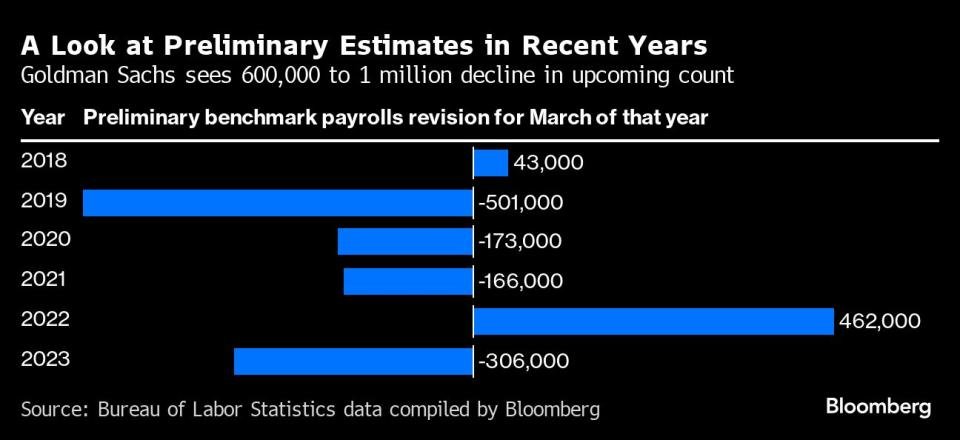

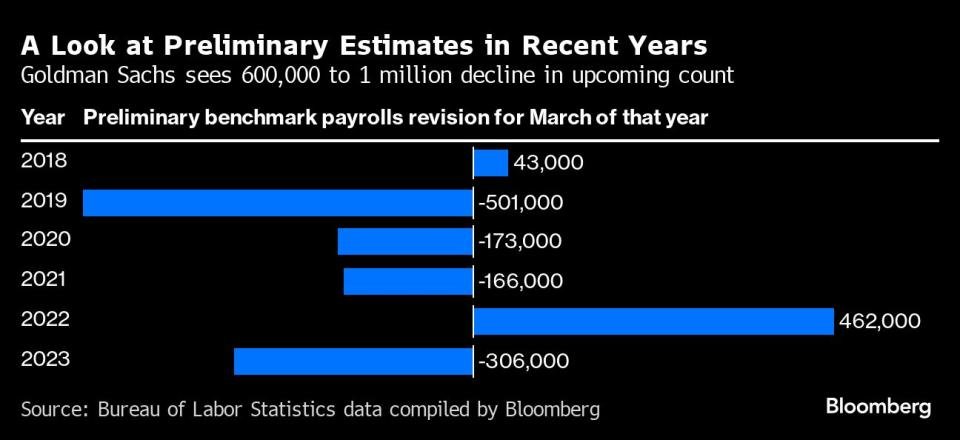

Economists Goldman Sachs Group Inc. and Wells Fargo & Co. preliminary revisions to the government’s benchmark on Wednesday are expected to show that wage growth in the year to March was at least 600,000 weaker than currently estimated – about 50,000 a month.

While forecasters JPMorgan Chase & Co. see a decline of about 360,000, Goldman Sachs indicates it could reach a million.

There are a number of caveats in the preliminary figure, but a downward revision in employment of more than 501,000 would be the largest in 15 years and suggest the labor market has been cooling for longer — and perhaps more — than previously thought initial. Final figures are announced early next year.

Such numbers also have the potential to shape the tone of Fed Chairman Jerome Powell’s speech later in the week in Jackson Hole, Wyoming. Investors are trying to get a sense of when and how much the central bank will start cutting interest rates as inflation and the labor market cool.

“A large negative revision would indicate that the hiring strength had already faded before last April,” Wells Fargo economists Sarah House and Aubrey Woessner said in a note last week. That would make “risks to the full-employment side of the Fed’s dual mandate more prominent amid broad softening in other labor market data.”

Once a year, the BLS benchmarks March payrolls against a more accurate but less timely data source called the Quarterly Census of Labor and Wages, which is based on state unemployment insurance tax records and covers almost all jobs in the US. The release of the latest QCEW report in June already suggested weaker wage gains last year.

As it stands, BLS data show the economy added 2.9 million jobs in the 12 months to March 2024, or an average of 242,000 per month. Even if the total revision is a million, monthly job gains would average about 158,000 — still a healthy pace of hiring, but a moderation from the post-pandemic peak.

Omair Sharif, president of Inflation Insights LLC, is optimistic that the revision will come to the lower end of the estimate range, in part because QCEW data tends to be more marked due to reporting delays.

Work risks

The preliminary review may rekindle the debate over whether the labor market slowdown risks a sharper shift in the economy. Employers cut hiring substantially in July, and the unemployment rate rose for the fourth month in a row. While that contributed to the $6.4 trillion global market selloff, the S&P 500 (^GSPC) made a full recovery.

“Markets, which recently experienced a growth scare that led to concerns that the Fed is behind the curve, will monitor Wednesday’s release of the benchmark review to see if the market’s initial reaction was, in fact, correct.” , said Quincy Krosby, general manager. global strategist at LPL Financial.

While other employment indicators have since reassured markets that the labor market is on solid footing, policymakers are still expected to start reducing borrowing costs in September.

Powell and his colleagues recently said he was focusing more on the jobs side of their dual mandate and would factor in the benchmark revisions in his speech at the Fed’s annual symposium on Friday.

“While Wednesday’s wage revisions have long been anticipated by the Fed, this will frame the mood and underscore that the picture of payroll strength is not as robust as it appeared in real time.” , Evercore ISI analysts Krishna Guha and Marco. Casiraghi said in a statement on Monday.

The government’s preliminary baseline projection will be followed by final revisions that are incorporated into the January employment report, which will be published in February.

Birth-death pattern

In most of the past years, monthly wage data has been stronger than the QCEW figures. Some economists attribute this in part to the so-called birth-death pattern — an adjustment the BLS makes to the data to account for the net number of businesses opening and closing, but that could be stopped in the post-pandemic world .

What Bloomberg Economics Says…

“While the Bureau of Labor Statistics’ ‘birth-death model’ still overstates employment from net new business creation, we believe the underlying rate of monthly job growth is likely less than 100,000 — below pace compatible with a constant unemployment rate. We expect the unemployment rate to reach 4.5% by the end of the year.”

—Anna Wong, Stuart Paul, Eliza Winger and Estelle Ou

Goldman Sachs’ Ronnie Walker says the QCEW figures could exaggerate the moderation in employment growth because they will remove up to half a million unauthorized immigrants who were included in the original estimates.

“Because the QCEW is based on unemployment insurance records, it likely largely excludes unauthorized immigrants, who we believe have been a strong contributor to employment growth over the past two years,” Walker wrote last week.

Bloomberg Businessweek’s most read

©2024 Bloomberg LP

#Fed #faces #million #jobs #disappearing #review