It’s the most wonderful time of the year.

No, not because winter is over, although that’s good.

No, not because it’s earnings season, although I love that.

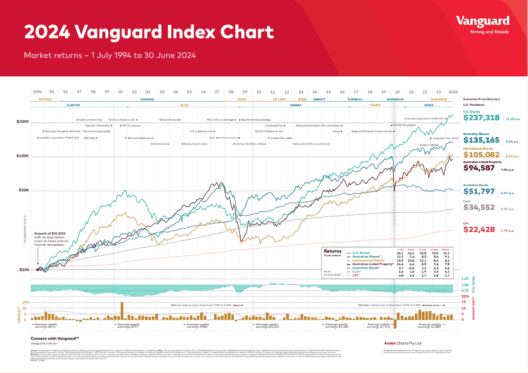

Its THE day. You know, Vanguard Index Chart Day.

(It’s probably not my favorite day of the year…but it’s damn close. It’s definitely my professional favorite!)

And that means you’re now in one of two camps: you either think I’m angry and feel disappointed, or you share my excitement and enthusiasm.

If you’re the latter, you’re welcome. The chart is just below… soak it up.

If you are in the former, please do me a favor and give me just two minutes to convert you.

See, you and I both know that a picture is worth a thousand words.

But this picture paints 1,000 words and about $135,000, give or take.

This image gives you and me a perspective and an anchor.

A little over two weeks ago, US and Australian stock markets fell sharply over the course of a few days.

The headlines screamed, the bears roared and many investors became very nervous.

I?

I just took a look at the latest Vanguard index chart to remind myself what we’re actually doing as investors and got back to work.

For the uninitiated, the Vanguard Index Chart shows the progress of a hypothetical $10,000 invested over 30 years in various asset classes, but especially stocks.

And it tells us a few things.

First, the most important.

That hypothetical $10,000, invested on July 1, 1994 and held for 30 years would have turned into:

$237,000 if invested in US stocks

$135,000 if invested in Australian shares

$105,000 if invested in international stocks

$94,000 if invested in Australian listed property; and

$51,000 if invested in Australian bonds.

Left to compound in cash, it would have become $34,500.

(None of the above includes commissions, brokerage, taxes, etc., or the benefit of franchising credits)

I will add here, in case anyone is wondering, that neither I nor The Motley Fool have a business relationship with Vanguard. I absolutely love this chart for its ability to tell and teach, and it’s the only resource I consider each the investor should print and keep somewhere!

In other words, here’s how your money would have multiplied over three decades:

23.7x, if invested in US stocks

13.5x, if invested in Australian shares

10.5x, if invested in international stocks

9.4x, if invested in Australian listed property; and

5.1x, if invested in Australian bonds.

Do you want this annualized? Sure!

11.1% per annum if invested in US stocks

9.1% per annum if invested in Australian shares

8.2% per annum if invested in international stocks

7.8% per annum if invested in Australian listed property; and

5.6% per annum if invested in Australian bonds.

I hope all these numbers impress you. It should.

They show us the extraordinary power of compounding over time when money is invested, then left alone, in quality assets.

They are, of course, historical numbers. There is no guarantee about the future.

And it continues a trend that goes back a long, long time. Not necessarily the same numbers, every year (in fact never the same, every year), but directionally, the lines are pretty similar.

And here’s where the rubber hits the road: For all the carry-on earlier this month, it’s the long-term picture that investors should focus on.

I don’t know how many times the ASX, for example, has fallen 5% in a few days in the last 30 years. I bet that happened quite a bit.

There have also been, as you can see, wars, terrorism, actual and future recessions, different parties in power, and some really impressive (in a bad way) market crashes, including the dot com crash at the turn of the century, the GFC. , and the COVID crash.

And yet?

And yet, the market still honestly delivered amazing earnings.

As Russell Crowe would have said, had he been a financial advisor rather than a gladiator, “Aren’t you impressed?”

At this point, people start with “yeah, but” and “what”.

If they’re genuine questions, rather than reasons not to listen, I’m all ears. Too often it’s the latter, because it doesn’t fit my interlocutor’s worldview.

But also most of the “what ifs” are dealt with, especially in the diagram.

I mean, sure, there could be another Great Depression, a meteor strike, or a violent overthrow of the government. It is possible that every company on the stock exchange suddenly and permanently becomes unprofitable.

I give you no guarantees.

Instead, I live my professional life in the world of probabilities. And given more than a century of history, I think the most likely outcome is that the future is directional like the past.

Humanity strives to improve itself. Much (though obviously not all) is achieved through new solutions to old and new problems, wants and needs, and delivered through publicly traded companies.

Have we really reached the pinnacle of human progress? And if we didn’t, aren’t our listed companies likely to get at least their share of the spoils of future earnings?

Now, I’m not saying that stock markets will never go down. In fact, I’m saying just the opposite: I think it’s incredibly likely that the next 30 years will include more than a few big, scary, heartbreaking falls…

… just like the last 30.

But I think the market will be significantly higher – probably somewhere around the historical average of 9% per year, but maybe more or less – in another 30 years.

A prediction? Not.

But the total amount of my investable assets, outside of my home, are invested in shares of Australian and American companies, because I believe that the past gives us a directional idea of the most likely future.

And that’s why I like the Vanguard Index Chart.

He shows us this journey. “Here’s one I made earlier,” as the TV chefs would say.

It reminds us that, well, things happen.

Good things for the most part, although they never make the headlines and go largely unnoticed.

Bad things sometimes that make headlines and tend to lead to nervousness and sometimes panic.

But overall? The direction of human progress is “up and to the right.” The same has been true, for over 100 years, of stock exchanges in Australia and the US.

And in the last 30, as the graph shows us.

So whenever the market wobbles, this is the chart I go back to. To remind myself that despite—not without—fear, crashes, and shortfalls, the market has tended to rise.

And in my view, it will continue to do so for a long, long time to come.

Happy Vanguard Index Day to all who celebrate. And, this year and beyond, I hope you are too.

There it is!

Silly!

#secret #stock #market #success #picture